Farr Law Firm is excited to partner with Retirement & Medicare Together to serve the Medicare needs of our clients.

We are working with Retirement & Medicare Together because of their knowledge, experience, and dedication to client service.

Why review your Medicare health plan every year?

$2,552 average annual savings per client on medications...

Your plan may make changes to how they cover the medications you are taking. That could cost you thousands of dollars unnecessarily.

Doctors change networks without telling patients...

Not only could your drugs change but so could your doctors. If your doctor no longer accepts your plan you will either pay higher costs to continue seeing that doctor or will need to change to a new doctor that accepts your plan.

Medicare Supplement Price Increase...

You should make sure you are paying the lowest price possible for your Medicare Supplement plan. Many people could save hundreds, or even thousands of dollars per year just by switching to a Plan G or Plan N. Contact us to see if you may qualify.

Extra Benefits...

Are you receiving all the extra benefits you are entitled to? Things like dental benefits, vision benefits, hearing benefits, and free gym memberships?

You May Qualify for a Special Enrollment Period...

If you have recently moved, retired, lost coverage, or entered a nursing home, you may be eligible for a new Medicare Supplement Plan or a new Medicare Advantage plan based on a “qualifying life event” that creates a Special Enrollment Period. Contact us for a free review of your plan; we might be able to find one that better fits your needs.

Start with a FREE Medicare review

I'm New To Medicare

Free Consultation

-

Explain your options

-

Help you enroll into Medicare

-

Sign you up for the right plan

-

Help you every step of the way

Group vs. Medicare

Free Comparison

-

Explore your situation

-

Explain your options

-

Cost comparison analysis

-

Constant support

I'm Retiring

Free Guidance

-

Sign you up for Medicare

-

Avoid penalties

-

Find the right plan for you

-

We're always here to help

"If I didn't review my plan I never would have known one of my medications was going to cost me $11,000 next year. Thankfully, Medicare Together was able to find a plan that covered all my medications."

Pam B.Miami, OH

"I didn't know that I was going to be charged extra for my Part B and Part D because of how much money I made. Thankfully, my advisor helped me and now we are saving over $600 a month on our premiums alone."

Stephen S.Nashville, TN

"I was researching Medicare on my own. All the information was confusing and conflicting. I didn't know what to do. I was introduced to RMT and they took the time to explain all my options so I could understand. I felt so much better because now I understood what needed to be done and I have someone to go through it with me each year.

Hayden F.Saint Paul, MN

What could happen if you don't review your plan every year?

- One or some of your medications may not be covered.

- Your company may increase your cost on certain medications.

- Your doctor could no longer accept your plan, meaning you will pay higher costs or need to change doctors.

- You may miss out on the benefits you are entitled to.

- You could miss out on the opportunity to lower your Part B premium.

- You may only have one chance this year to review your plan.

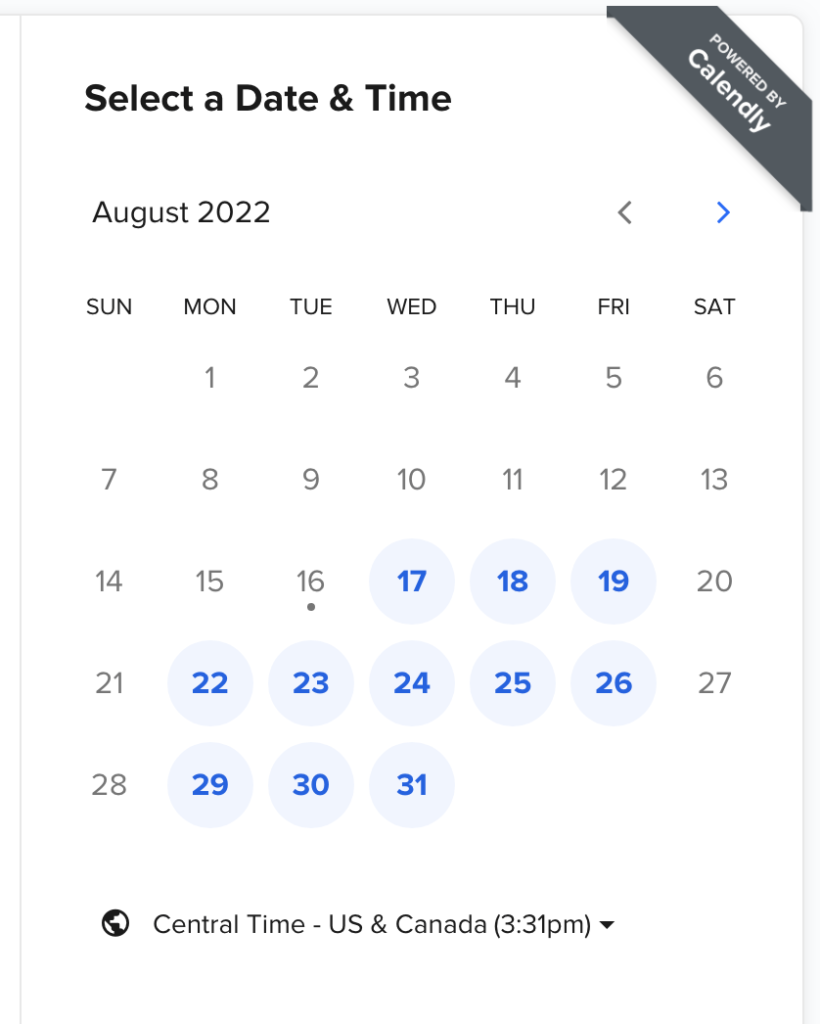

Schedule your FREE Medicare review today!

Attention:

By calling the 800 number, completing the form, or scheduling a call you are agreeing to the Insurance Disclosure & Consent form below. Click the button below to view the Insurance Disclosure & Consent form.